Protect Your Business From Fraud

Watch our podcast to learn how you can safeguard your business against fraud. Our experts outline the key fraud scams targeting business owners and companies now and into the future. Understand more about the psychological attack vectors used by fraudsters to initiate a fraud attack. Find out what are the key actions you can take, working together with your employees, to protect your business and your financial wellbeing.

Stop, Think, Check. And together, we won’t let the fraudsters win.

Protect Your Business From Fraud (Business On Line Customers)

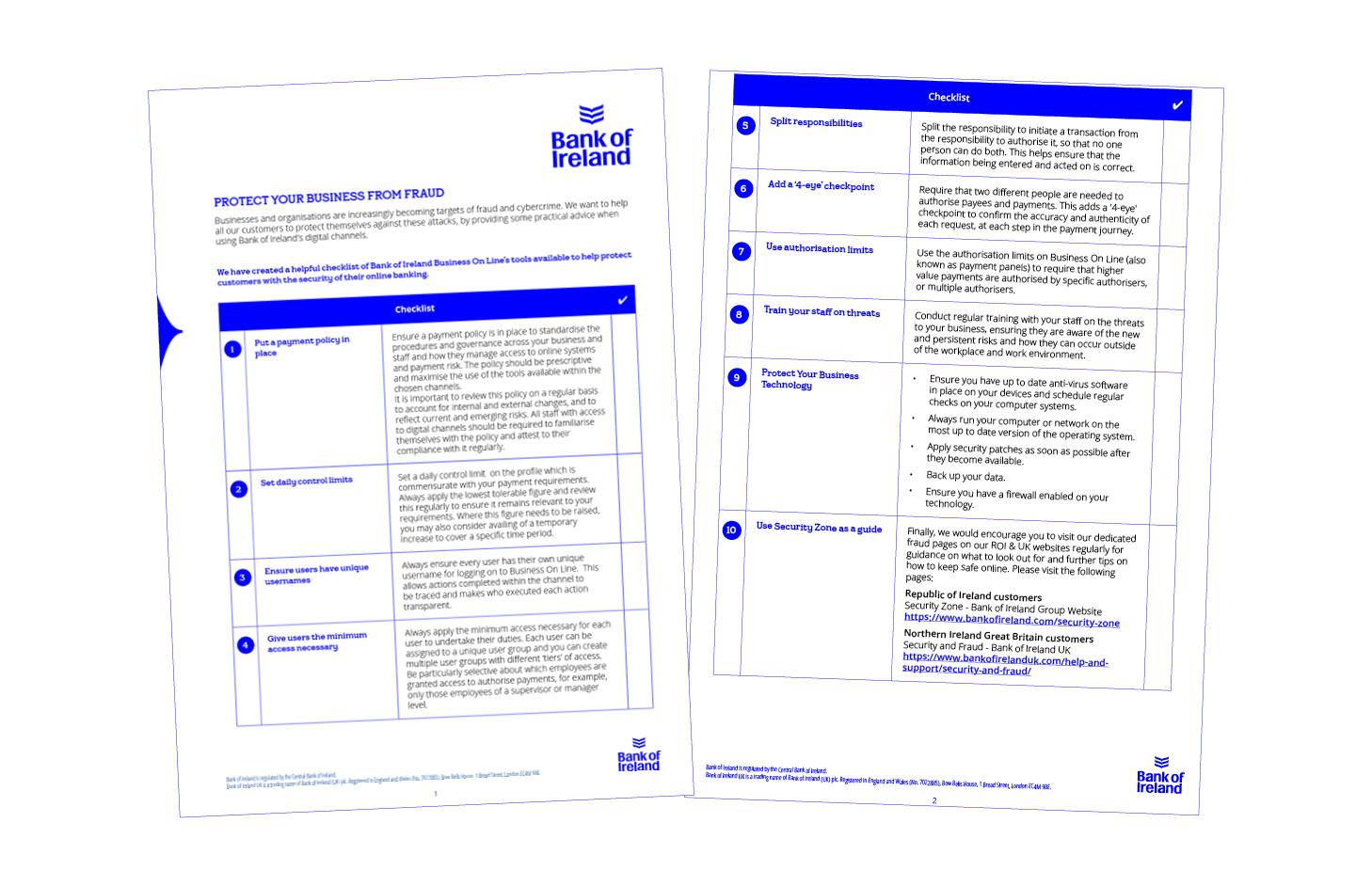

Businesses and organisations are increasingly becoming targets of fraud and cybercrime. We want to help all our customers to protect themselves against these attacks, by providing some practical advice when using Bank of Ireland’s digital channels. We have created a helpful checklist of Bank of Ireland Business On Line’s tools available to help protect customers with the security of their online banking.

Download checklist

Payment redirection fraud

Payment redirection fraud is where fraudsters pretend to be a supplier or service provider for your business in order to trick you into changing bank account payee details. They contact you to tell you that their bank account details have changed and to ask you to send all payments to a new account. This is an account controlled by the fraudster.

How to keep safe Download Brochures

Business email compromise

Business email compromise, also known as CEO impersonation fraud, is a type of fraud where the fraudster pretends to be a senior executive from your organisation. They will send an email to an employee to try to trick them into doing something, like making a payment to either an existing or new client or supplier.

How to keep safe Download Brochures

Vendor email compromise

Vendor email compromise is a variation of business email compromise where fraudsters hack business email accounts of reputable vendors to place large orders of products with their suppliers or to issue fake invoices.

How to keep safe

Ransomware

Ransomware is a type of malware that prevents the victim from accessing many files on their computer and on any fileshares they are connected to.

It is usually downloaded via a link in an email, on a website or on social media. Once downloaded, it encrypts all data files on the computer and a blocking screen then appears, demanding a ransom payment to allow the files to be released.

How to keep safe

Remote access fraud

Fraudsters sometimes make “cold calls”, pretending to be from a reputable technical support or IT company. They persuade you to allow them to take control of your computer remotely over the phone so that they can fix, upgrade or protect your computer. They may ask you to log on to your online banking account or ask for bank, credit card or other personal details. Bank of Ireland will never call and ask you for provide your Keycode app PIN or the one-time passcodes generated by the Keycode App. They will never ask you to download any software so they can take control of your computer or phone, or to move your money to a “safe” account.

How to keep safe

Cheque Overpayment

Fraudsters sometimes target legitimate sellers of goods or services by posing as new customers and placing an order. The fraudster typically pays the seller a higher amount than agreed ‘by accident’ by cheque or bank draft in a bank branch.

How to keep safe

Protect your business technology

It is important that you properly protect all of your business technology, including mobiles, tablets, laptops and computers . This will help safeguard them against the potentially serious consequences of fraud.

How to keep safe