Bank of Ireland announces changes to fixed mortgage interest rates – 2019

- Popular 3% cashback offer extended to December 2019

- 1 and 2 year fixed rates drop below 3%

- 9 in 10 new owner occupier mortgage customers opting for fixed rates

From today Wednesday 30 January 2019, Bank of Ireland has revised its Homeloan fixed rate mortgage offering with changes of between 0.10% and 0.20% across the product range.

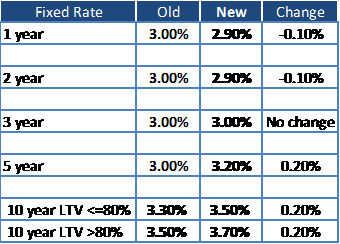

The interest rate for both the 1 and 2 year fixed rate mortgages is coming down by 0.10% to 2.9%. This is the first time in recent years that Bank of Ireland mortgage rates have dropped below 3%. The 3 year fixed rate remains unchanged at 3%. In line with our medium term view of the rates market, the interest rate for longer fixed terms – 5 and 10 year offering – is increasing by 0.20% (5 year fixed now 3.2%, 10 year fixed now 3.5% up to 80% loan to value and 3.7% above 80% loan to value).

Brian Vaughan, Head of Mortgages at Bank of Ireland said, “Bank of Ireland offers a competitive range of options for mortgage customers. The rate changes announced today starting at 2.9%, together with the availability of the 3% Cashback offer until December 2019, reflect this. These new rates are available to new mortgage customers, to our existing mortgage customers on a variable rate and to customers coming to the end of a fixed rate period. Existing customers on a fixed rate will continue on their current rate until the end of their term.

“While to date we have provided a flat 3% rate across most of our fixed rates, today’s adjustments are consistent with the medium term market expectations in relation to rates. Our fixed term rates have been very popular, with more than nine in ten new owner occupier mortgage customers opting for fixed rates in 2018”.

Table of new rates attached.

Legal info for website:

Bank of Ireland is regulated by the Central Bank of Ireland.

3% cashback available to First Time Buyers, Movers and Switchers who are Bank of Ireland Current Account customers and draw down a new mortgage until 31 December 2019. 2% cashback on drawdown of a new mortgage plus 1% bonus in 5 years subject to meeting the conditions of the mortgage.

The lender is Bank of Ireland Mortgages. Lending criteria and terms and conditions apply, over 18s only. A typical mortgage to buy your home of €100,000 over 20 years with 240 monthly instalments costs €615.79 per month at 4.2% variable (Annual Percentage Rate of Charge (APRC) 4.3%). APRC includes €150 valuation fee and mortgage charge of €175 paid to the Property Registration Authority. The total amount you pay is €148,114.60. We require property and life insurance. You mortgage your home to secure the loan. Maximum loan is generally 3.5 times gross annual income and 80% of the property value (90% of the property value for first time buyers). A 1% interest rate rise would increase monthly repayments by €54.02 per month. The cost of your monthly repayments may increase – if you do not keep up your repayments you may lose your home.

Warning: If you do not keep up your repayments you may lose your home.

Warning: You may have to pay charges if you pay off a fixed–rate loan early.

Warning: If you do not meet the repayments on your loan, your account will go into arrears. This may affect your credit rating, which may limit your ability to access credit in the future change.

Bank of Ireland Mortgage Bank trading as Bank of Ireland Mortgages and The Mortgage Store is regulated by the Central Bank of Ireland.