Bank of Ireland cuts all fixed mortgage rates by 0.50%

- Lower rates are available to new and existing customers

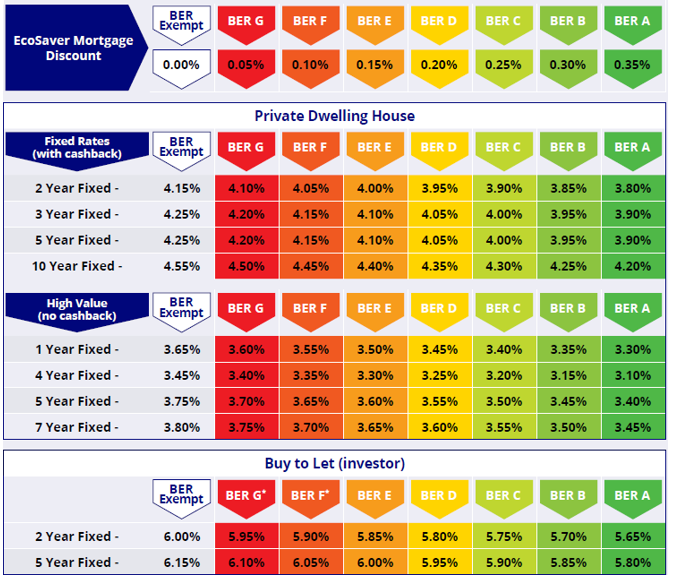

- 4-year fixed rate is now available from as low as 3.1%

- New 1-year fixed rate launched today from as low as 3.3% (no cashback)

Bank of Ireland is cutting its fixed mortgage rates by 0.50% from today (19 November) for new and existing customers and for all homes with a Building Energy Rating (BER) from A to G.

The reduction announced today means that a 4-year fixed rate is available from as low as 3.1% (dependent on BER), representing an annual saving of approximately €1,000 on a €300,000 mortgage when compared to the previous 4-year fixed rates.

Bank of Ireland is also introducing a new 1-year fixed-rate product (no cashback) with rates from as low as 3.3% for mortgages of €250,000 and over.*

The lower rates are available to new customers and also to existing customers who are coming to the end of their fixed rate period and seeking to re-fix their mortgage, or tracker rate or variable rate customers who wish to move to a fixed rate.

Alan Hartley, Director of Homebuying at Bank of Ireland, said: “Offering value to our customers is important so this 0.50% cut is being applied to our full suite of fixed rate products. These reduced rates are available to all new and existing customers from today and they apply all the way up and down the BER scale, not just to those homes with the best energy ratings.”

In April 2024 Bank of Ireland redesigned its fixed-rate mortgage offering to align with energy ratings. Our EcoSaver mortgage provides customers with a range of tiered discounts for all properties with a BER from A to G, with the interest rate reducing the more energy efficient a home is. Once you have an EcoSaver mortgage, you can still benefit from home energy upgrades because the interest rate comes down every time your BER improves.

Fixed-term deposits

The Bank is also making two changes to its deposit offering from today:

- Introducing a new 18-month Advantage Fixed Term Deposit Account with an AER of 2.98%.

- Removing our 24-month fixed-term deposit with AER of 2.96%.

Withdrawal of 25% of the savings balance is access permitted during the term of the Advantage Fixed Term Deposit Account.

*From 26 November new customers can avail of the new 1-year fixed rate (no cashback) of between 3.30% and 3.65% dependent on BER, subject to High Value Mortgage eligibility criteria. For existing customers the 1-year fixed rate will reduce to between 3.30% and 3.65% on 19 November dependent on BER. The existing 1-year fixed rate with cashback will no longer be available.

Ends

Notes to Editor

The 0.50% reduction announced today applies to all Bank of Ireland fixed mortgage rates, including for BER Exempt properties. There is no change to Bank of Ireland variable and tracker rates.

Bank of Ireland EcoSaver mortgage fixed rates from 19 November 2024